It’s commonplace to refer to the U.S. consumer as the engine that drives the country’s economy.

The observation is grounded in truth, given the fact that consumer spending accounts for roughly 70% of GDP.

But we’re witnessing the emergence of the “cautious consumer,” as tracked through PYMNTS Intelligence’s data, and as relayed through various economic reports.

As of this writing, stocks are swooning, down more than 2%, on Friday (Aug. 2). The labor market is cooling, and the unemployment rate is up. Wage growth, though positive, has not been enough to really give a tailwind to disposable income.

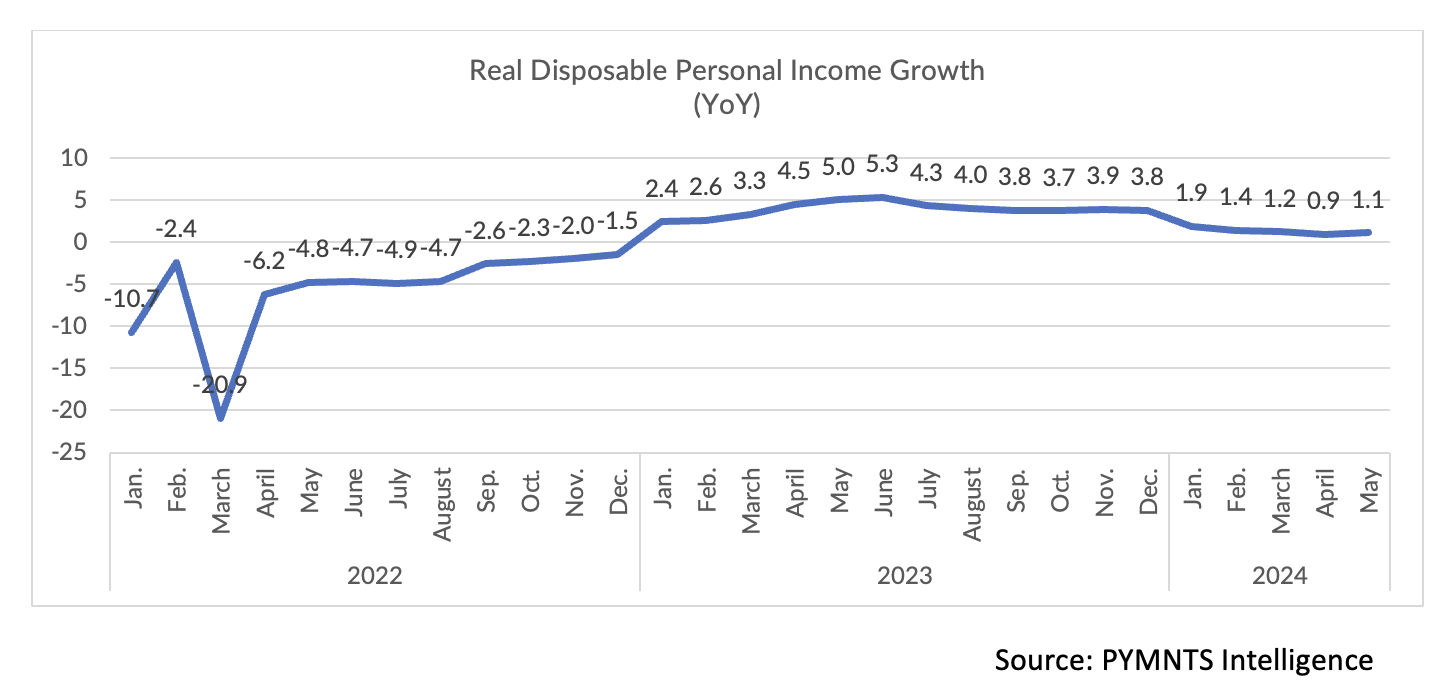

The chart below details the trend: Real disposable income, adjusted for inflation, turned negative amid soaring prices through 2022. Now that inflation’s abated a bit, real incomes are growing, though at a muted pace, roughly 1% year over year, where that rate had been in the mid-single digit percentage points at this time a year ago.

As the growth has slowed, the savings rate as a percentage of disposable income now stands a bit about 3%, having come down from about 5% a year ago. In the meantime, PYMNTS has found that consumers are depleting their savings every few years. If savings are depleted and the savings rate is relatively low, building up those cash reserves takes longer … and longer.

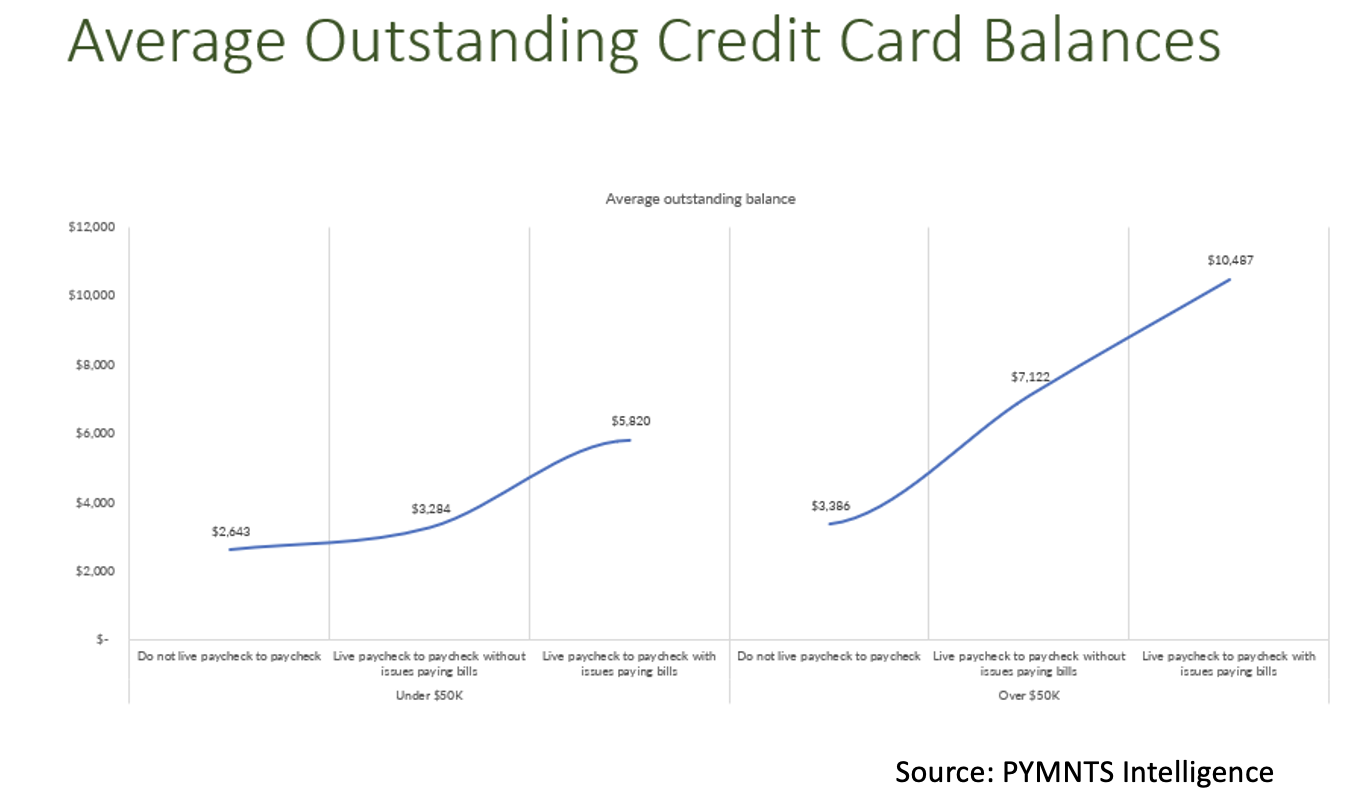

The indebtedness level of the U.S. consumer doesn’t help matters, particularly given the hump in card debt being carried across all income levels, and particularly for paycheck-to-paycheck consumers, as seen below.

Consumer have been cautious since the beginning of the year, as PYMNTS found that at the time, 55% of shoppers earning less than $50,000 annually and 57% of those earning $50,000-$100,000 switched to cheaper merchants due to price increases of retail products. Even higher-earning shoppers are making such sacrifices, with 45% of those who earn more than $100,000 a year doing the same.

The sentiment factor should not be discounted here. The University of Michigan’s monthly consumer sentiment survey noted last week that there’s a “wealth gap” when it comes to the outlook on what’s to come, as individuals who own stocks tend to feel relatively better off than those who do not.

“Consumers with the largest stock holdings have seen a 71% increase in sentiment since June 2022, in contrast to only an 11% gain for those without stocks,” per the survey. The recent volatility — and new downdrafts — in stocks might change the sentiment of consumers with much of their wealth tied up in portfolios.

The Conference Board’s Present Situation Index, which evaluates current business and labor market conditions, dropped to 133.6 from 135.3, indicating that consumers perceive the present economic situation as slightly deteriorating from a month ago.