New Report: What’s in Gen Z’s Mobile Wallet?

Consumers are embracing digital wallets, and more than 70% of consumers globally now use one. In fact, many consumers have stored credentials and used a digital wallet to verify their identities or to access events. PYMNTS Intelligence’s data shows satisfaction with the convenience and ease of use among consumers around the world.

Generation Z consumers in particular are making the most use of these wallets. These consumers store payment information and IDs or access information in the wallets. In fact, 10% of Gen Z say they rarely or never carry a physical wallet anymore.

These are just some of the findings detailed in “Digital Wallets Beyond Financial Transactions: A Global Perspective,” a PYMNTS Intelligence and Google Wallet collaboration. This report examines consumer perceptions and use of digital wallets in five key markets: Brazil, France, Germany, the U.K. and the U.S. It draws on insights from a survey of 12,299 consumers conducted from Jan. 11 to Feb. 5, 2024.

Other key findings in the report include:

Convenience and rapid processing drive satisfaction with using digital wallets for verification or access.

Consumers say the easy access and rapid processing when they use digital wallets for access or verification is impressive. Across the five countries studied, 74% of consumers who use these wallets for these nontransactional purposes show high satisfaction. Those using government-based apps for storing IDs are least likely to be satisfied.

Gen Z sets an example by using credentials stored in digital wallets more frequently.

PYMNTS Intelligence finds a usage gap. While 20% of consumers worldwide have stored credentials, only 8% actually used stored credentials in the last year. Among Gen Z consumers who use digital wallets, however, 11% used their stored credentials. This may explain why Gen Z consumers are the most likely to leave their physical wallets behind altogether.

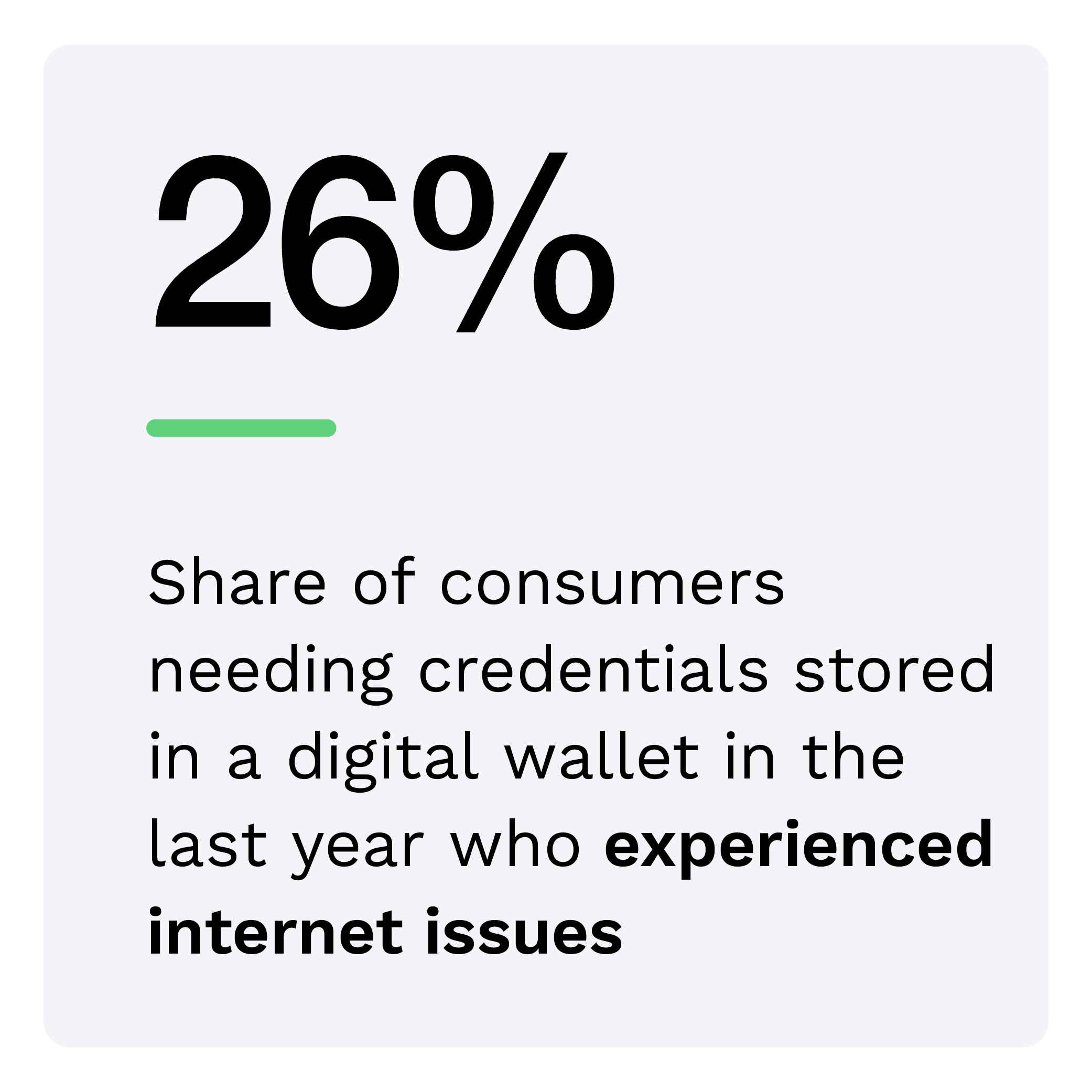

Many users cite internet connectivity issues as an issue in nontransactional activities.

One consistent hiccup digital wallet users experience is lack of internet access. Many consumers (26%) report internet issues hindered their ability to use the apps. This is a particularly significant problem in Brazil, which leads in adoption. Despite this, significant shares of consumers prefer them for verifying their identities online.

The role of this technology in consumer’s lives is evolving. Consumers who use them report high levels of satisfaction, but providers need to continue to innovate and reduce frictions. Download the report to learn what digital wallet usage in Brazil, Germany, France, the U.K. and the U.S. reveals about what the future holds.