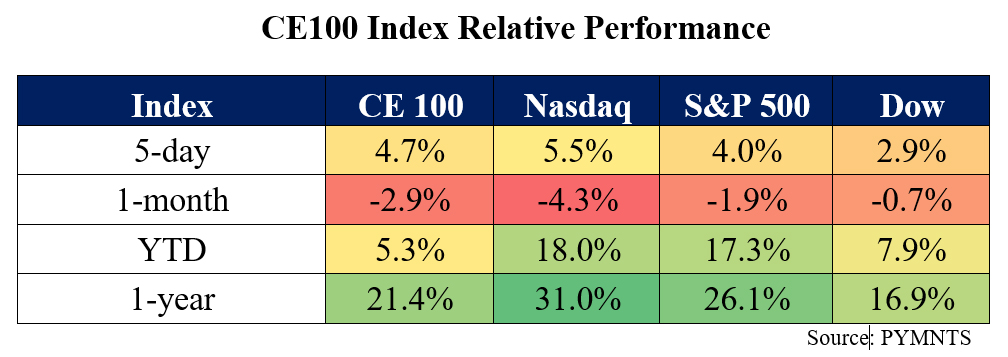

Earnings were everywhere this past week, propelling the CE 100 Index 4.7% higher, and any losses seen among our names were negligible. In fact, most of those declining stocks slipped less than 1%, except Tencent, which was down double digits.

Vroom shares rallied by nearly 64%, driving the Shop segment of the CE 100 Index up by about 11%.

Following the company’s wind-down of eCommerce operations, the current units of UACC, which offers vehicle financing through third-party dealers, and Carstory, which offers AI-driven analytics for automotive retail, continued to show momentum.

The company’s presentation materials noted that Vroom’s origination metrics indicate continued migration toward higher quality credit. The gross serviced accounts stood at 82,161 in the latest quarter, where that tally had been 79,896 in the year-ago period. The indirect origination volumes in the second quarter were $116 million, compared to $92 million a year ago. Net interest income in the second quarter of 2024, after losses and recoveries, was $18.1 million and had been $5.9 million last year.

Walmart also drove the shopping pillar higher, having surged 8.1% in the past week. As reported here, quarterly revenue across all of Walmart’s business lines rose about 5%.

Consolidated operating income was up $0.6 billion, or 8.5%; adjusted operating income was up 7.2% due to higher gross margins and growth in membership income, as well as reduced eCommerce losses. Overall, eCommerce sales were up 21%; Walmart Marketplace sales were up 32%.

Adyen shares posted the next-largest gain after Vroom’s dramatic uplift, at 20.7%, as the Pay and Be Paid segment was 4% higher. In our coverage of earnings, Adyen posted first-half results that showed North America was the fastest growing region with net revenue growth up 30% year over year, followed by EMEA, where net revenues were up 25% year on year; the Asia Pacific region gained 15% in net sales as measured against last year. Net revenue for the Dutch firm was 913.4 million euros, up 24% year on year.

The company said in its earnings materials that during the half, the company processed volumes of 619.5 billion euros, up 45% year over year.

The company’s Unified Commerce offering, as detailed in its filings, saw volumes surge 29% year over year, and point-of-sale (POS) volumes gathered 32%. POS volumes were 15% of total processed volumes.

Visa shares were up 2.9%, and Amazon’s stock was roughly flat. In an announcement this week, Amazon teamed with Santander to launch a new Amazon Visa card in Germany.

The card lets users earn rewards while shopping on and off Amazon’s Germany website, according to the release at the beginning of the week.

“Cardholders can pay for their purchases quickly, intuitively and securely through Zinia, Santander’s consumer finance platform, and they are able to choose between full and revolving payments any time,” the release said.

The announcement comes weeks after reports that Amazon and Santander were at work on a deal in which the Spanish bank would provide financing options for Amazon customers across the European Union, starting in Germany.

Those gains were blunted at least a bit by Tencent’s 18.8% decline.

Tencent Holdings reportedly said it is in discussions with Apple about sharing revenue from its WeChat mini-games.

Tencent is exploring adding in-app transactions via Apple’s iOS payment system, which would allow Apple to begin taking a cut of those transactions, Tencent Chief Strategy Officer James Mitchell said during the company’s earnings call.

“We want to make it available on terms that we think are economically sustainable, that are also fair,” Mitchell said on the call. “And so that’s a discussion that’s underway, and we hope that the discussion leads to a positive outcome.”

During the second quarter, Tencent’s gross receipts from mini-games — which are accessed through the WeChat app — rose by more than 30%. Overall, Tencent’s revenues were up 8% to RMB161.1 billion ($22.6 billion) compared to a year ago.