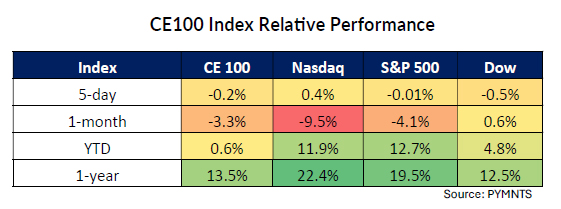

The CE 100 Index lost 0.2% last week in the wake of earnings reports that, over the course of the past several days, have moved names to the upside (and the downside, of course).

Shares of Sezzle soared 51%, and the Pay and Be Paid pillar moved 5.9% higher.

In the company’s most recent earnings report, management ramped up its revenue expectations on the heels of greater demand for buy now, pay later (BNPL), as sales moving ahead were guided to be higher by 35%-40% year over year (previous guidance of 25%).

“As shoppers want to use us everywhere and as a regular part of their daily lives, it’s both exciting and rewarding to see,” Sezzle CEO Charlie Youakim told the company’s earnings call audience.

In the latest quarter, underlying merchant sales (UMS) increased by 38.9% year over year to $532.2 million, surpassing the previous non-holiday quarterly high. Consumer purchase frequency rose to 4.8 times from 3.3 times in the same period in 2023. Total revenue grew by 60.2% year over year to $56 million, accounting for 10.5% of UMS.

Elsewhere, Shopify shares gathered 27.3%, bringing the Shop segment 0.8% higher.

As reported here, management noted that the company’s point-of-sale (POS) solution is gaining traction, with offline gross merchandise volume (GMV) increasing by 27% year over year. Cross-border sales accounted for 14% of Shopify’s GMV in Q2, highlighting the eagerness of merchants to reach new regions. Shopify Payments penetration reached 61%, and Shop Pay facilitated $16 billion in GMV, up 45% from the previous year.

Zillow was 17% higher. Revenue in the most recent quarter was 13% higher to $572 million. The company’s latest shareholder letter noted that rentals revenue was 29% to $117 million, primarily driven by a 44% increase in multifamily revenue, and residential revenue was 8% higher to $409 million, besting total industrywide transaction growth of 3%. The company’s mobile apps and sites logged 231 million average monthly unique users, roughly flat year over year.

But those gains were blunted by Vroom’s skid, where the shares were 33.7% lower.

The second quarter, as Vroom said, interest income in the latest quarter stood at $51.8 million, compared to $47 million in the year ago quarter. Within the UACC segment, interest income was up 10.2%. As had been reported earlier in the year, the company had moved to wind down its eCommerce operations and discontinue its used vehicle dealership business.

Porch Group’s stock lost more than 31%, driving the Live segment 3.3% lower. The company noted total revenue of $110.8 million for the most recent quarter, an increase of 12% or $12.1 million compared to the prior year (second quarter 2023 results here were $98.8 million), driven by the insurance segment, including a 28% increase in premium per policy and lower reinsurance ceding. The latest top line report missed consensus expectations by about 6%.

Porch’s financials flagged that its 21% attritional loss ratio for the quarter, an improvement from 35% in the prior year, was driven by the insurance profitability actions. Policies in force, per the company’s latest financials, were down 35% year on year to 232,000.

iRobot shares plummeted about 25%, as the company noted that second quarter revenues came in at the low end of expectations, affected by what management termed a “more challenging consumer spending environment.” Revenues were down 29.6% to $166.4 million.