As summer sales events like Amazon Prime Day and Walmart+ Week annually draw significant consumer attention, a recent PYMNTS Intelligence report examines key insights into shopper behavior and sales trends.

The report, “Shoppers Flocked to Amazon Prime Day and Walmart+ Week For More Than Discounts,” examines how consumers navigated these promotions, what they purchased and the broader implications for both retailers.

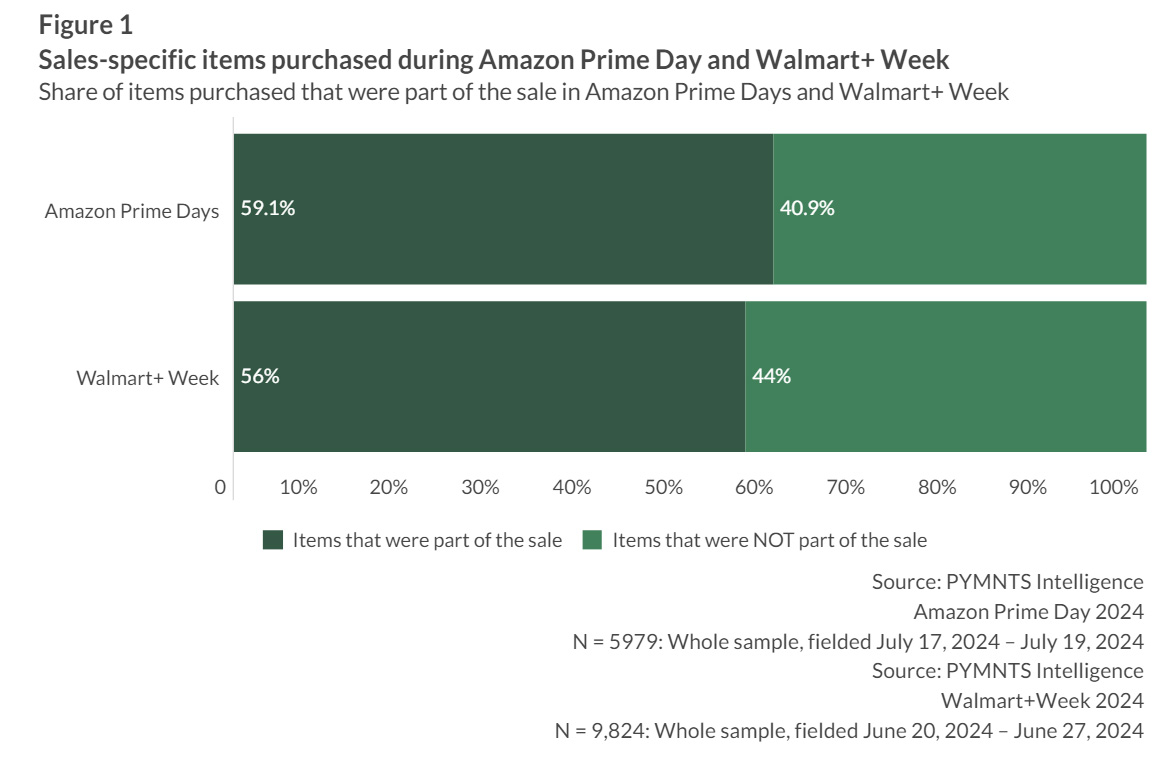

Amazon Prime Day and Walmart+ Week are often viewed as discount-driven events, but recent data reveals a more nuanced reality. Contrary to this perception, a substantial portion of purchases during these events were made at regular prices. Specifically, 41% of items bought on Amazon Prime Day were full-priced, while 44% of Walmart+ Week purchases were not discounted.

Generational trends further illustrate this complexity as baby boomers and seniors largely favored discounted items during Prime Day, whereas Generation Z maintained a more balanced approach, buying both sale and regular-priced goods. During Walmart+ Week, 61% of Gen Z consumers opted for discounted products.

Walmart+ Week also saw 56% of purchases on sale and 44% at full price. These insights suggest that while discounts are a major incentive, consumers are also leveraging these sales events to stock up on essentials, regardless of price. This trend highlights how such events drive overall spending growth, benefiting both discounted and regular-priced items.

Both Amazon Prime Day and Walmart+ Week underscored the significant role of health and beauty products in shopper carts. During Amazon Prime Day, 44% of participants bought health and beauty items, while 42% opted for clothing and accessories. Walmart+ Week showed an even greater preference, with 62% of shoppers purchasing health and beauty products. This trend highlights the category’s appeal due to its affordability and consumability, which encourages bulk buying during these sales events.

The disparity in product pricing between the two retailers could explain Walmart’s higher share in health and beauty sales. Walmart offers more budget-friendly options, while Amazon features a range of luxury items. This difference could influence consumer preferences and purchasing patterns during these sales events.

Amazon Prime Day and Walmart+ Week revealed a strong consumer tendency to stock up on an array of products. Walmart+ Week shoppers averaged 20 items per purchase, far surpassing the 11 items bought by Amazon Prime Day participants. This trend was particularly pronounced among younger consumers, with Gen Z and millennials leading the charge, purchasing more items than their older counterparts during both sales events.

Specifically, Gen Z and millennials averaged 22 and 21 items, respectively, during Walmart+ Week, while baby boomers and seniors averaged 16 items. During Amazon Prime Day, Gen Z and millennials bought an average of 12 and 13 items, respectively.

While both events attract deal-seeking consumers, this trend shows Walmart+ Week’s higher number of products per shopper suggests a stronger focus on groceries and essential items. Amazon Prime Day participants also used the opportunity to stock up, but with a lesser emphasis on groceries compared to Walmart.

Amazon Prime Day and Walmart+ Week are more than just promotional sales; they are critical periods for capturing consumer spending across various product categories. Consumers are leveraging these events not only to receive discounts, but also to make essential purchases and stock up on necessities. Based on the report’s insights, Amazon and Walmart continue to use these events as a strategic battleground to enhance their market positions and attract diverse consumer segments.